One of the biggest factors in planning for your business is around taxes – paying them, mitigating them, maximizing your exemptions, and so on.

But, when legislation changes as it often does, these exemptions have a huge impact on how you plan for your business.

According to the IRS, the current Estate Tax Exemption will sunset at the end of 2025, again changing the exemptions applicable for your business. Here at Consolidated Planning, our experienced business planning professionals work with business owners to create strategies to better coordinate solutions that address the key issues we know all business owners face as they reach the ultimate exit from their business.

In this article we’ll highlight the difference in estate planning and estate tax planning, what the estate tax and estate tax exemption is, and how you will determine the distribution income necessary to retire from your business the way you want.

Estate Planning vs. Estate Tax Planning

Estate Planning involves the organization and management of an individual’s assets during their lifetime and the eventual distribution of those assets upon death, via the reading of the Final Will & Testament or a Trust. Planning for the distribution of your estate includes:

- Providing for the financial well-being of family members

- Minimizing the administrative burdens and costs associated with transferring assets, and

- Establishing mechanisms for managing financial and healthcare decisions in case of incapacity

Estate planning is true for each and every person regardless of their worth.

Now, Estate Tax Planning specifically focuses on strategies to minimize the potential impact of estate taxes on the transfer of assets from one generation to the next. This kind of planning includes:

- Reducing or eliminating estate tax liabilities

- Preserving the maximum value of the estate for heirs and beneficiaries, and

- Ensuring the efficient transfer of assets while minimizing tax consequences

Planning for both your estate and your estate tax is essential for business owners with a large net worth to best redirect and adequately manage wealth for whatever the tax landscape looks like.

The biggest question you need to ask yourself is, “Am I doing the RIGHT amount of estate tax planning?”

What Is The Estate Tax?

The Estate Tax has been around for decades and has gone through countless legislative changes. Most of what has changed is the exemption amount. And that’s what matters most for your business.

Now, as a business owner, you’re at least aware there is an exemption amount. But, legislatively, in 2010 there was actually no Estate Tax for a moment in time. Why was that?

In 2000, the President and Congress put in an Estate Tax law that would sunset in 10 years. Sunsetting in these terms means the intentional phasing out or termination of something. In this case, the exemptions.

So, the exemption amounts went up and up and then sunset.

Because it wasn’t revenue neutral, they couldn’t make the Estate Tax permanent in 2010 so it went away for just one year. Then the tax sunset and went back to the way it was. A few years later, there was another legislative shift where the exemption was increased to 5M per person.

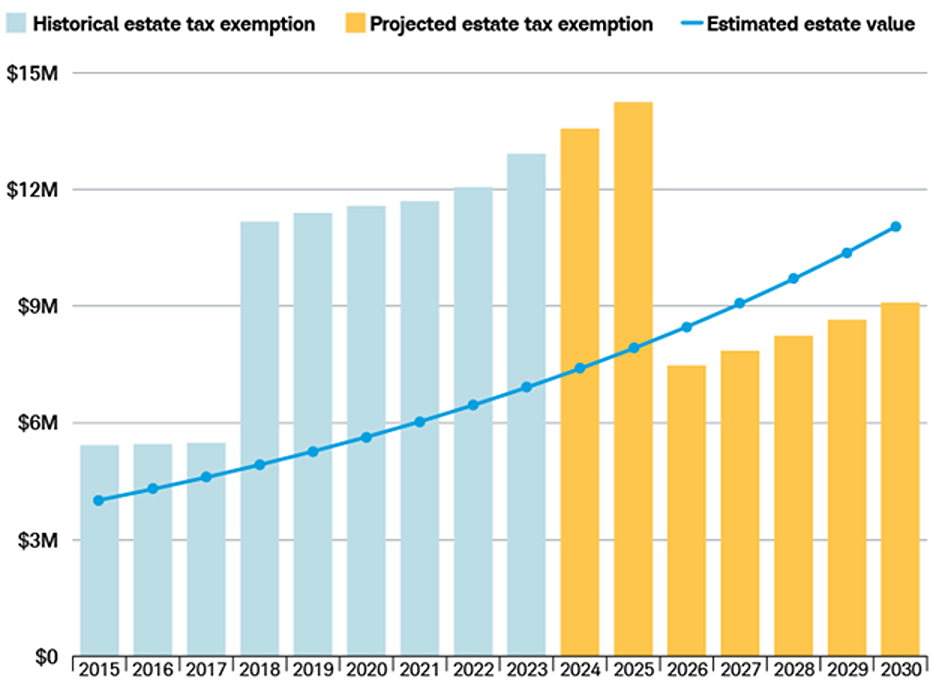

And finally in 2018, another set of estate tax changes were made that upped the exemption, but these laws once again sunset in 2025. When these laws sunset in 2025, the estate exemption amounts reduce back to the 5M per person limits, indexed for inflation.

Of course, Congress could come back in 2025 with additional legislation but this below graph is the trajectory of what is to come:

Source: Schwab Center for Financial Research.

The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product. Dividends and interest are assumed to have been reinvested, and the example does not reflect the effects of taxes or fees. Assumes an individual estate value of $4 million, 7% estimated annual return, 5% inflation rate, and reduction of the estate tax exemption to $7.48 million in 2026.

What Is The Estate Tax Exemption And Why Does It Matter To Your Business?

Unlike Estate Planning, business owners who are worth more than 7M+ likely have an estate tax planning concern. But, oftentimes business owners don’t necessarily feel wealthy, even with this high net worth. That is because the majority of this money is IN the business and very illiquid.

It is likely that after December 31, 2025, the current exemption will revert back to 2017 levels, cutting your estate tax exemptions nearly in half. HALF. And when you’re talking in terms of potentially 10 to 20 M of net worth, that taxable estate is substantial. SUBSTANTIAL. Especially when it comes to personal planning and planning for the needs of your business.

If and when the Estate Tax sunsets, the lower threshold will potentially mean a few things for your business:

Increased Tax Liability

Business owners with estates exceeding the lower exemption limit may face higher estate taxes. This could affect the transfer of your business assets to heirs, potentially leading to increased tax burdens.

Estate Planning Changes

Business owners may need to revisit their estate planning strategies to account for the reduced exemption. This could involve exploring different tools and techniques, such as trusts, to minimize the impact of estate taxes on their businesses.

Financial Planning

The potential changes in estate tax laws could influence the overall financial planning of business owners. You may need to work with an experienced professional to reassess your investment and wealth management strategies in light of the evolving tax landscape. Let’s not forget that your personal balance sheet feeds your business and vice versa.

Succession Planning

Business succession planning may become more complex if the estate tax exemption decreases. Owners may need to consider alternative methods for passing down their businesses to heirs while minimizing tax implications.

Liquidity Concerns

A lower estate tax exemption could lead to liquidity challenges, as business assets might need to be sold or liquidated to cover the tax liabilities. This could impact the continuity and sustainability of the business.

Determine Your Necessary Distribution Income Based On The Estate Tax Exemption

Based on the projected Tax Estate Exemption, it’s crucial for business owners to determine their distribution planning income first and foremost. Don’t let the tax lead you, rather ask yourself these questions:

- Where do you go from here?

- What is your exit strategy?

- What is your retirement income strategy based on this pending decision?

You have a few options when it comes to getting your Estate Tax Planning in order:

- Transfer Assets: Transferring assets out of your name is something no one wants to do. But, sometimes people do, if it’s the right kind of asset (ill-liquid, part of the taxable estate, and highly appreciated overtime). You could move some of the estate into someone else’s name or put it in a trust. But this is an irrevocable transfer.

- Buy Life Insurance

- Hope Legislatively It Works Out: Aside from projections, it’s hard to say what exactly will happen with the Estate Tax Exemption until it’s actually announced. But, you can always choose not to worry about it and simply hope it works out in your favor.

Is Your Business Prepared For A Lower Estate Tax Exemption?

As a business owner, it’s always in your best interest to plan for the unexpected in your business. And the Estate Tax Exemption that is likely to sunset at the end of 2025 is exactly why adequately planning matters.

If you know you’re going to do the responsible thing and pay your estate taxes, it might make sense to use your exemption now. But, you can only use it once. If you’re fine financially stable and won’t run out of money, using your estate sooner than later allows your assets to appreciate outside of your estate.

However, if you don’t know whether or not you have enough money for the remainder of your life, you should not be transferring assets that you might need.

To understand the right way to redirect your net worth that aligns with your estate tax planning, talk with an experienced professional at Consolidated Planning.

2024-170760 Exp. 3/2026

Guardian, its subsidiaries, agents and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation. The information provided is based on our general understanding of the subject matter discussed and is for informational purposes only.

This material contains the current opinions of Andy Brincefield and Consolidated Planning only. These are not the opinions of Park Avenue Securities, Guardian, or its subsidiaries.