Your buy-sell arrangement is one of those things that needs to be revisited on a regular basis.

The new U.S. Supreme Court decision made in June 2024 is a perfect example of why this is true.

Here at Consolidated Planning, we pride ourselves on aligning with you and your business journey. From protection, to growth, to exit, the right strategy makes all the difference in your business and financial future.

In this article we’ll help you understand the new U.S. Supreme Court decision, how it potentially affects your operating agreement, and solutions for protecting yourself and your largest asset moving forward.

What Is The New U.S. Supreme Court Decision?

The new U.S. Supreme Court decision in the case of Connelly v. Internal Revenue Service (IRS) says, according to the IRS, that a corporation’s contractual obligation to redeem shares is not necessarily a liability that reduces a corporation’s value for purposes of the federal estate tax. In other words, having any kind of corporate owned life insurance in your business agreement, is now viewed as an asset without a corresponding liability.

Does This Ruling Affect Your Buy-Sell Agreement?

This ruling affects those businesses with an Entity Purchase or Stock Redemption Agreement in place. If this is you, ANY corporate owned life insurance, once paid out, is added to your business’ fair market value.

When your agreement is triggered, upon death of one owner or member, the surviving owner or member, the company, will redeem the shares of the deceased owner from his or her estate. Redeeming these shares means the company is bringing the shares back into the fold in return for whatever that payment is.

So, what’s the problem?

The Connelly ruling says the corporate owned life insurance proceeds are now added as a line item to the value of the company. So a company that was worth 6M with 3 equal shareholders inside of it and 2M of life insurance proceeds, upon payment, is worth 8M, according to the IRS.

But, is it really?

For a moment in time, yes.

However, the life insurance proceeds only temporarily inflate the value. Once the shares are redeemed, the value will now deflate. Now, the IRS and Supreme Court are not wrong because there is cash in there and it’s of real value to the company. But, even if the benefit is appropriately funded pre-death, once those proceeds are paid out, we have an inflation of the value of the company. This value must be listed on the estate tax return of the deceased member or owner.

With that, the executor of the estate must now seek the inflated value. Those 2M in life insurance proceeds would have been fine if the business was worth 6M but since it’s now worth 8M, the redemption value is now worth 2.67M.

The buy-sell agreement is now underfunded.

Solutions For Businesses

The good news is, there are potential solutions available to you depending on how many owners or members there are.

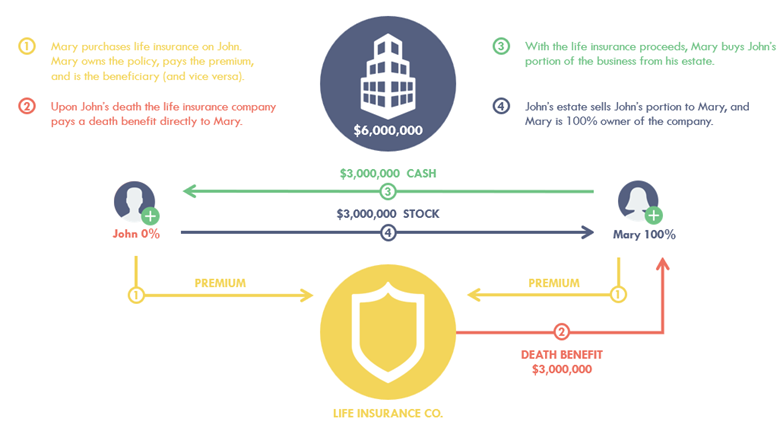

#1 Cross Purchase Agreement

With two owners or members, a Cross-Purchase Agreement is a good solution. In fact, this is likely the agreement that should have been carried out in the first place. Most of the time, it’s ideal to write the check from the company, which is a valid reason for establishing an Entity Purchase Agreement.

Here, each owner or member would purchase life insurance on each other and own the policy, and the owners agree to buy and sell each other’s ownership interests.

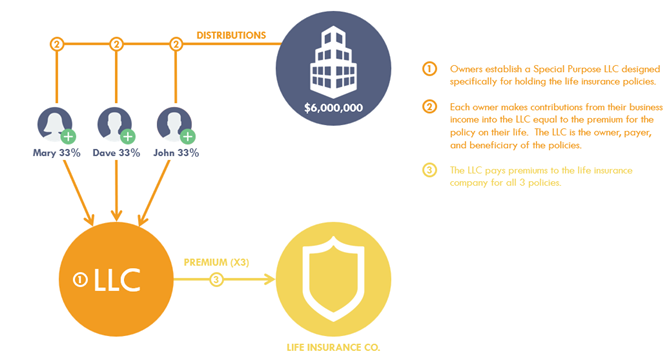

#2 Special Purpose LLC

With more than two owners or members, it’s likely a Stock Redemption plan which makes the Special Purpose LLC a good choice for your business.

Here you would form another LLC with the same members or owners of the original business which buys life insurance on each of the members. An internal assignment of the contracts to avoid incidents of ownership by the insured on his or her own policy. If this isn’t done properly, the Connelly ruling may affect this agreement as well.

Remember that the best Buy-Sell structure for your business should align with your objectives, protect the interests of all owners, and provide a clear framework for handling ownership changes.

Structure The Best Buy-Sell Agreement For Your Business

If you are in fact set up as an Entity Purchase Agreement, your business’ value goes right back to what the value was the day after the Buy-Sell Agreement is executed. Essentially, you would be overpaying for shares but that’s simply what the value stipulates.

Maybe you’re thinking, Can’t I just move my policy from my company to my partner?

Well, yes, but there are nuances when it comes to transferring your value and how you will be taxed.

To set up the right Buy-Sell Agreement for your business or switch existing policies, talk with an experienced business planning professional to take the proper steps to minimize tax problems in the future.

7213702.1

Exp. 10/2026

Guardian, its subsidiaries, agents and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation. The information provided is based on our general understanding of the subject matter discussed and is for informational purposes only.

This material contains the current opinions of Consolidated Planning only. These are not the opinions of Park Avenue Securities, Guardian, or its subsidiaries.